BECU’s 2021 Annual Report: Co-op Dedicated to Financial Well-Being of Over 1.3 Million Members and its Communities

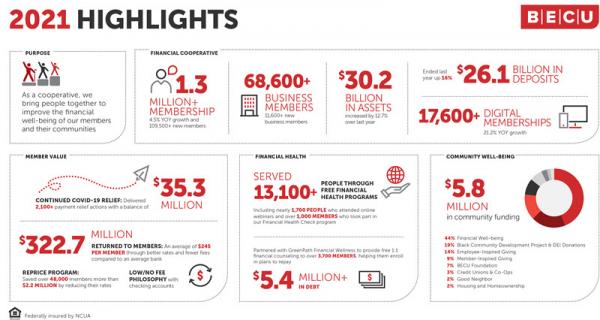

SEATTLE (May 12, 2022) — BECU, the country’s largest community credit union, released its 2021 Annual Report on BECU.org ahead of its sixth annual Member Summit event this evening. The member-owned financial cooperative ended the year with more than 1.3 million members (a 4.5% increase), $30.2 billion in assets (a 12.7% increase) and a net worth (capital) ratio of 9.82%. In addition, over 17,600 members joined BECU digitally in 2021, a 21.2% year-over-year growth.

“Since our founding in 1935, BECU has dedicated itself to supporting members during challenging times, and this past year was no exception. We continued to evolve how we serve our members and communities and are proud to see our overall efforts making positive impacts on their financial health,” said Benson Porter, BECU’s president and chief executive officer. “Our history of steady growth and financial stability enables us to help more members navigate economic uncertainty and save for a rainy day, while also focusing on the long-term strength of our business and giving back to the communities we call home.”

Return to Members

BECU returned $322.7 million to its members last year through better rates and fewer fees compared to bank averages (an average of $245 per member). An example is its Reprice Program, which automatically reduces interest rates on qualifying loans and credit cards for those who demonstrated healthy financial habits. Over 48,000 members saved more than $2.2 million through the program.

Additionally, the credit union helped ease the impacts of the pandemic through more than 2,100 payment relief actions by waiving fees and offering deferred payments for members.

Member Products and Services

In 2021, BECU rolled out new and improved product and service offerings designed to enhance the member experience, including:

- Testing new BECU Envelopes, which helps members direct money toward specific savings goals through various digital "envelopes” within their BECU savings or Money Market accounts.

- Expanding its loan payment window from 12 to 27 days, simplifying the process for early member loan payments.

- Increasing financial accessibility for sight-impaired members by launching new braille and raised, embossed credit cards and redesigning its online Money Manager tool.

To better support its more than 68,600 business members, BECU enrolled 38,000 LLCs, corporations and partnerships in its new Business Online Banking platform. The credit union also funded 2,500 loans for a total of $70.6 million through the Small Business Administration’s Paycheck Protection Program (PPP), helping keep approximately 7,800 jobs on the payroll.

Extending Community Support

To support local communities, BECU donated $5.8 million in cash and in-kind donations last year to nonprofit organizations and partners focused on increasing financial well-being. Key efforts include:

- Grants to a variety of local organizations that offer financial education and training, workforce and entrepreneur development, and safe and affordable access to financial services, including SNAP (Spokane Neighborhood Action Partners), FareStart, Business Impact NW and NW Innovation Resource Center.

- Black Community Development Project: the second year of a five-year $5 million commitment to support nonprofit partners that improve the Black community’s financial health and well-being.

- Member-Inspired Giving: granted $535,000 to more than 30 nonprofit organizations and BECU members that dedicated their time to helping others in BECU’s service areas through its annual People Helping People Awards program.

The credit union also helped educate over 13,100 people through free financial health programs, including BECU-hosted online webinars and seminars, one-on-one Financial Health Checks and financial reality fairs. In addition, BECU partnered with GreenPath Financial Wellness to provide free financial counseling to over 3,700 members, helping them to enroll in plans to repay more than $5.4 million in debt.

More information on BECU’s total commitments and accomplishments is available in the following sections of its 2021 Annual Report:

About BECU

With more than 1.3 million members and $30.2 billion in assets, BECU is the largest not-for-profit credit union in Washington and one of the top four financial cooperatives in the country. As a member-owned credit union, BECU is focused on helping increase the financial well-being of its members and communities through better rates, fewer fees, community partnerships and financial education. The credit union currently operates more than 50 locations in Washington and two financial centers in South Carolina. For more information, visit www.becu.org.